nevada estate and inheritance tax

From Fisher Investments 40 years managing money and helping thousands of families. Inheritance and Estate Tax Rate Range.

Nevada Inheritance Laws What You Should Know

Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value.

. Nevada Inheritance and Gift Tax. Nevada Estate Tax. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax.

The federal estate tax exemption is 1118. Estate taxes and inheritance taxes are similar but there are some important differences to note. No estate tax or.

Select Popular Legal Forms Packages of Any Category. Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is responsible for paying the tax. If the total amount of the deceased persons assets exceeds.

Nevada also does not have a local estate. Compare the best Estate Tax lawyers near Carson City NV today. Nevada currently does not have an estate tax.

Nevada State Personal Income Tax. There is no inheritance tax in Nevada. Fortunately Nevada does not.

Under Nevada law there are no inheritance or estate taxes. From Fisher Investments 40 years managing money and helping thousands of families. No Estate Tax Laws in Nevada To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on.

It is one of the 38 states that does not apply an estate tax. The estate tax is on the estate of the deceased person before the inheritance gets disbursed. The State of Nevada sales tax rate is 46 added to.

Inheritance taxes in contrast are only levied on the value of assets transferred and are paid by the heirs. Technically the Las Vegas sales tax rate is between 8375 and 875. However if a beneficiary of an estate lives in a state that imposes an inheritance tax then the beneficiary may have to pay that tax to their state.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Also when real estate is transferred from. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

No estate tax or inheritance tax. NV does not have state inheritance tax. The inheritance tax always goes hand-in-hand with the estate tax levied on the property of the recently deceased before it is transferred to heirs.

However an estate in Nevada is still subject to federal inheritance tax. Gift taxes are levied when property is transferred by a living. Use our free directory to instantly connect with verified Estate Tax attorneys.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Attorney BlackRock Legal 10155 West Twain Ste. Nevada does not levy an inheritance tax.

Find an Attorney. Our Rule of Thumb for Las Vegas sales tax is 875. Nevada does not have an estate tax but the federal government has an estate tax that may apply if your estate has sufficient value.

But Nevada does have a relatively high sales tax a state rate is around 7 but. Nevada repealed its estate tax also called a pick-up tax on Jan. Nevada imposes an estate tax equal to the maximum credit allowed under the federal tax code for paid state estate and.

It gets paid out of the estates funds. Nevada does not impose an inheritance tax. In 2021 the first 117mil per individual is.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. All Major Categories Covered. Property Tax Rate Range.

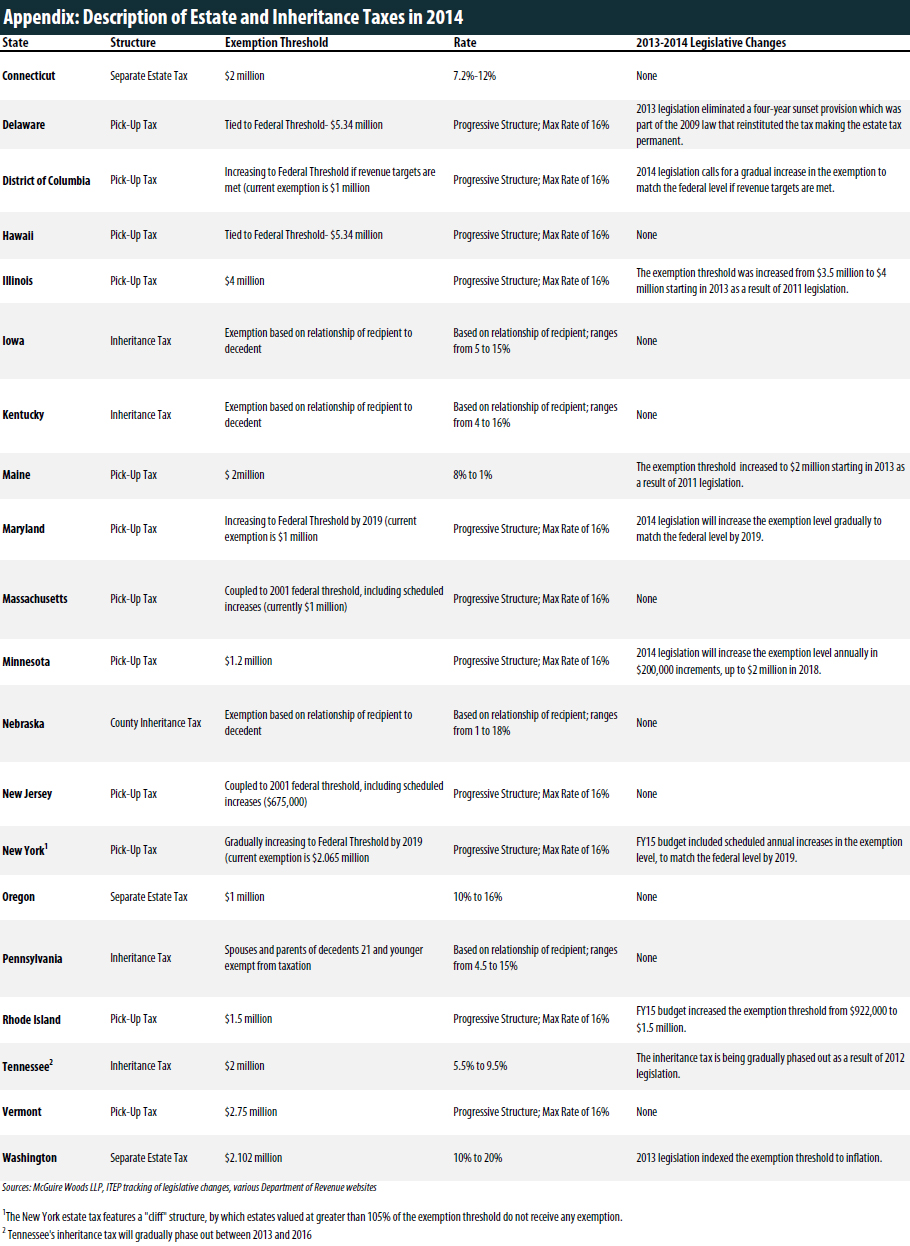

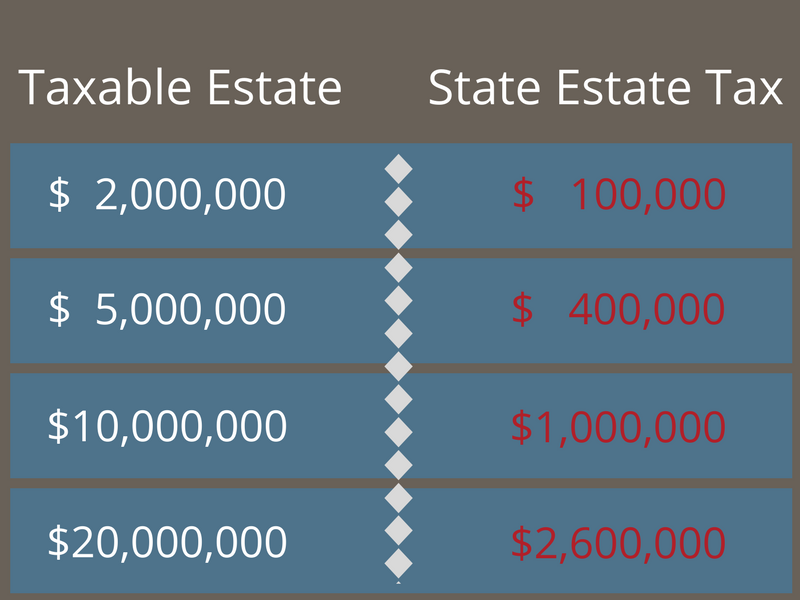

Nevada is one of 38 states that does not levy an estate tax. Because of the phaseout of the federal estate tax Nevada does not require an estate tax filing for decedents whose date of death was. The top estate tax rate is 16 percent exemption threshold.

Under Nevada probate law probate is the process of verifying the proper transfers of property after a persons death. This increases to 3 million in 2020 Mississippi. Inheritances that fall below these exemption amounts arent subject to the tax.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Nevada is one of the seven states with no income.

If you have questions regarding Nevada inheritance tax estate tax gift tax or any other estate. Nevada repealed its estate tax also called a pick-up. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a.

Here are the answers to five common Nevada inheritance tax questions.

Estate Tax Planning In Nevada Stone Law Offices Ltd

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The 10 Best Places To Retire In Nevada Newhomesource Best Places To Retire Nevada Places

State Estate And Inheritance Taxes Itep

How To Avoid Estate Taxes With A Trust

Why You Need A Will Probate Divorce Lawyers Attorneys

How To Avoid Estate Taxes With A Trust

Recent Changes To Estate Tax Law What S New For 2019

Here S Which States Collect Zero Estate Or Inheritance Taxes

Nevada Inheritance Laws What You Should Know

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Changing Residency Affects State Estate Tax And Income Taxes

State Estate And Inheritance Taxes Itep

Green Check Mark In Box Estate Planning Planning Tool Animated Clipart

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Estates And Trust Services Tax Lawyer Inheritance Tax Divorce Attorney